Published on .

Health plans need to secure high Star Ratings to survive in the Darwinist world of Medicare Advantage. What do plans need to know about the Star Ratings and how can they outperform their peers to thrive in this challenging environment?

The growing success of Medicare Advantage stems from the ability of consumers to choose the best plan for their needs in an open marketplace. Beneficiaries place very high value on the ability to shop around for services—and with an average of almost 40 plans to choose from, members are often quick to rebuff plans falling short of expectations.

The Medicare Advantage Star Ratings system is intended to provide a data point as a reference for consumers when choosing a health plan for their healthcare insurance needs. The ratings condense dozens of complex quality, member experience and other plan performance factors into a simple 5-star graphic members can use to inform their choice.

In addition, Star Ratings affect plans’ rebate percentages. Plans that score 3.5 or 4.0 receive a 65% rebate percentage (vs 50% for 3.0 Stars or less). Further, plans that score 4.5 or 5.0 Stars gain a 70% rebate percentage. And, if the county within which the plan is located is considered “double bonus,” the rebate percentage is doubled. This is important because per a Kaiser Family Foundation study, “Rebates must be used to reduce cost sharing, subsidize the standard Part B and/or Part D premium, or pay for supplemental benefits (such as vision, dental and hearing).”

The many advantages of scoring 4+ Stars

The impact of moving from a 3 to a 4-Star rating is influential, as it leads to an 8–12 percent increase in member enrollment per a recent study by Guidehouse. However, it isn’t necessarily just the consumer’s viewpoint of the Star Rating that drives the increased member enrollment. Plans are incentivized heavily to invest in Star Ratings programs in order to at least score 4 or more Stars to gain a slice of the nearly $10 billion Quality Bonus Payment (QBP) with an average of around $400 per member/per year in increased revenues.

Moreover, the Guidehouse study illustrates that the leap from 3 to 4 Stars increases plan revenue between 13.4–17.6 percent, through the increased enrollment and QBP dollars. Said another way,

Star Ratings performance impacts tens of billions of dollars in revenue for MA plans.

In addition, 5-Star plans can market the plan all year long, rather than just during the open enrollment period, allowing them to attract more potential members and outmaneuver other plans.

Drawbacks of scoring less than 3 Stars

In the “survival of the fittest” environment, lower-quality plans earning less than 3.0 Stars are subject to a number of negative consequences, including encouragement from CMS to beneficiaries to change plans due to the low quality.

CMS also enacted a new regulatory change in which plans scoring lower than 3.0 Stars cannot market for additional membership until the ratings improve during a future year. “To hold plans to a higher standard,” in the CMS Final Rule for 2023 Medicare Advantage, CMS prohibits new applications or service expansion for plans that score 2.5 Stars or lower.

These outcomes are critical for plan sponsors. Those that rise to the challenge enjoy a wide range of rewards designed to foster exponential growth over time. Meanwhile, those plans that can’t “keep up with the pack” are destined for lower enrollments or contract termination.

Shifting to the extremes: Examining trends from the 2023 Star Ratings

Despite CMS efforts to steady the MA environment during the pandemic, the public health emergency has actually widened the gap between high performers and plans at risk of falling behind, as revealed by the 2023 Star Ratings data. It’s still possible to bridge the growing gulf between the “haves” and “have-nots,” but it will become harder and harder for plans that don’t invest in key competencies linked to crossing that all-important 4-Star threshold.

The 2022 Star Ratings brought an astonishing rise in the number of 4- and 5-Star plans, thanks to CMS intervention during the worst of the pandemic. More than two-thirds of plans (68%) crossed the 4-Star barrier that year.

Experts predicted this bump in performance would be temporary, however, as the ratings system shed its COVID-era flexibilities and settled back into a new normal. The 2023 results have shown exactly that, with the number of plans earning 4 or more Stars settling back to 51%, much more in line with the 49% of plans clearing the 4-Star threshold in the 2021 Stars.

We can safely view 2022 as an outlier and instead compare Star Ratings data from 2021 and 2023 to get a better idea of how the industry is trending. For some, it’s moving in a very good direction—but for an increasing number of plans, the end of COVID’s less stringent rules spells bad news for their public reviews.

The latest data reveals that more and more plans are either doing very well or very poorly.

In 2021, for example, the vast majority of MA plans earned between 3 and 4.5 stars. Only 1% fell into the 2-2.5 Star category, and 5% secured 5 Stars. But for 2023, 8% percent of plans have fallen into the 2-2.5 Star bucket, while 11% shot upwards into the 5-Star category.

This slide outward means that more plans will have access to the benefits of being in the top tiers—a positive development for members, perhaps, but an upcoming challenge for 4- and 5-Star plans that will now be competing with more high performers than ever before.

Why some plans are significantly outpacing others

There are several factors at play in the race to the extremes. Despite the higher number of 5-Star plans, overall performance across the rating system is declining. When numbers drop across the board, the Star Ratings system responds by easing off the cut points, or thresholds between Star categories, to avoid a catastrophic collapse in rankings. Cut points can never increase or decrease by more than 5%.

But not all the cut points get easier. In fact, some get harder, even in times of stress. The 2023 Star Ratings saw just under half of the cut points get easier to reach. But 24% got more difficult to achieve—including those for some of the most heavily weighted measures around medication adherence and patient experiences. Measures that got harder in every threshold include RAS adherence, Statin Adherence, Statin Use in People with Diabetes and Members Choosing to Leave the Plan.

Diving deeper into the numbers, it becomes clear that plans performing better on key medication adherence and CAHPS measures are much more likely than others to achieve 4 or more Stars.

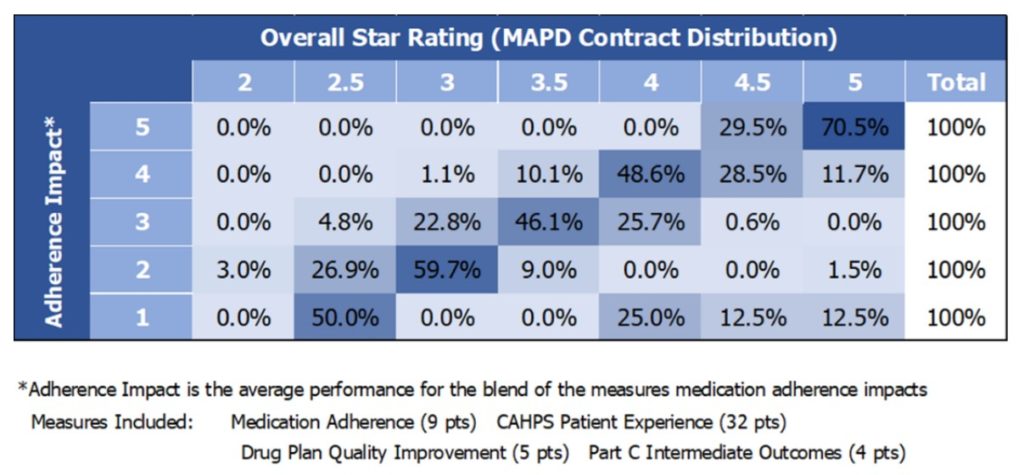

The following correlation chart represents the distribution of Medicare Advantage Part D (MAPD) plans nationwide based on performance in Adherence Impact measures* and the overall Star Ratings:

For each score of 1-5 on the vertical ‘y’ axis, the displayed percentages reflect the portion of plans who achieve a specific overall Star Rating of 1-5, which is reflected on the horizontal ‘x’ axis. For example, of the plans averaging 2 stars in the Adherence Impact measures, 59.7% achieved a 3-Star Rating overall. Conversely, plans that achieve fewer than 3 Stars on certain individual medication adherence measures are much less likely to crack the 4-Star threshold overall.

Becoming strong enough to survive in the modern MA landscape

To stay on the right side of the divide, MA plans need to focus their efforts on targeted, high-value activities with the most possible bearing on their ultimate Stars outcomes.

Not surprisingly, these activities also bring enormous and direct benefits to members, particularly for high-risk, high-complexity members who are often unengaged with their care and struggle to self-manage their health. Improved medication adherence is essential for these individuals and is strongly correlated with better chronic disease management, reductions in avoidable utilization and higher satisfaction with their health plans.

MA plans will need to employ a coordinated combination of sophisticated population health analytics, innovative member engagement strategies and digital pharmacy services to reach medication adherence goals.

By identifying rising risks in high-needs individuals, addressing those concerns proactively and compassionately, and providing concrete resources to members requiring extra attention, plans can improve outcomes and generate positive experiences. As a result, plans are likely to see better performance on adherence measures, more impressive CAHPS scores and more opportunities to rise to the top of their regional marketplace.

Learn more about how your plan’s Star Ratings stack up to the competition and actionable steps you can take for future success by registering for our December 7 webinar, “How to Improve in 2023: SDOH, CAHPS and New Stars Measures”.