Published on .

High performance on the CAHPS survey is crucial for securing a top score in the Star Ratings scale. How can Medicare Advantage plans deliver holistic, engaging experiences to members to succeed in both measurement systems?

As the leaves fall and the calendar year draws to a close, health plans must look towards the future. The close of the 2021 performance year promises both significant challenges and new opportunities to the dynamic Medicare Advantage (MA) marketplace.

In performance year 2021, CMS has gotten serious about pushing MA plans to produce better results for members. In addition to removing the COVID-19 protections that resulted in artificially inflated Star Ratings for 2022, CMS has implemented major changes to the way MA plans are held accountable for member experiences.

The Consumer Assessment of Healthcare Providers and Systems® (CAHPS®) survey is slated to be the focal point of these adjustments, as CAHPS scores will now account for nearly a third of the overall Star Ratings score.

The survey period begins in March 2022 and will reflect “the past six months” of member experiences. This means that as the performance year ends, so too does the opportunity to make an impact on member experiences and ensure satisfactory ratings on the coming survey.

Even with the current methodology, there is a clear and strong relationship between average CAHPS performance and overall performance, explained Kempton Presley, Chief Analytics Officer AdhereHealth, during a recent virtual panel discussion.

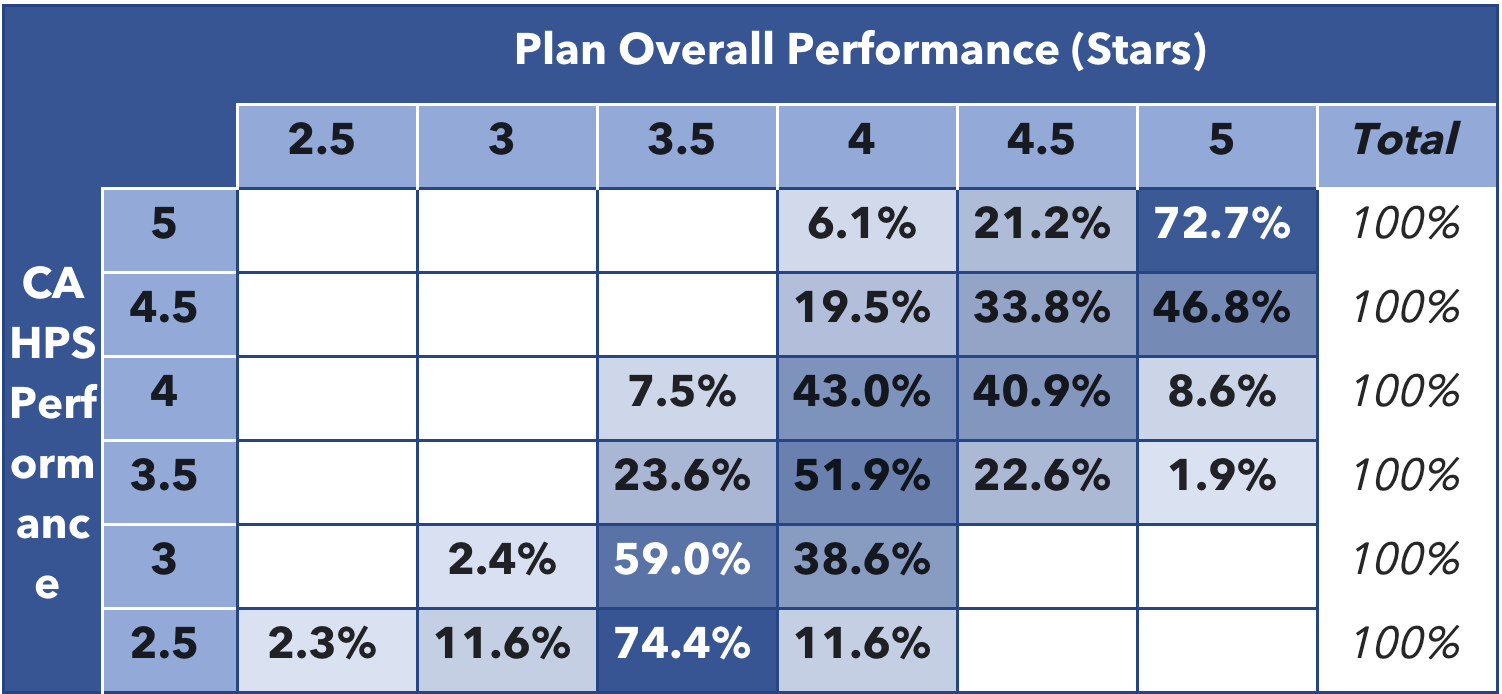

Table 1: Correlation Between CAHPS® Performance and Overall Star Rating

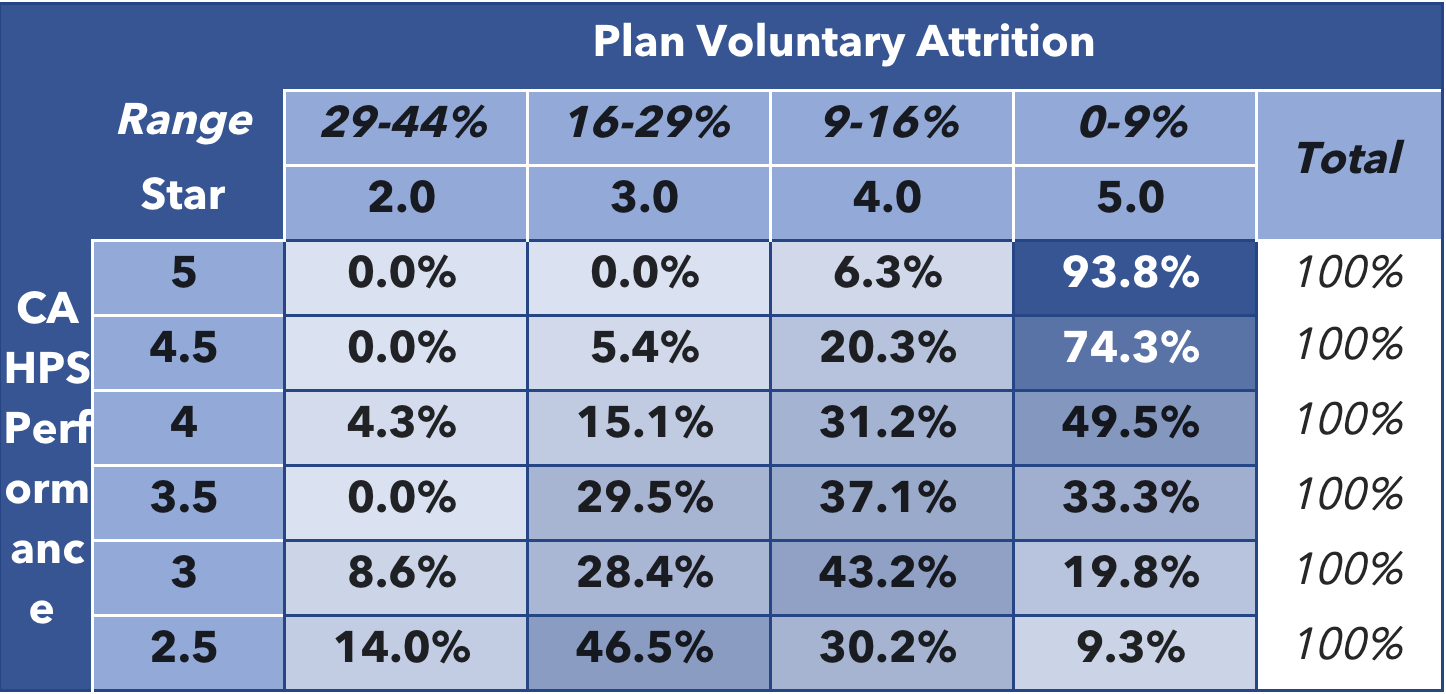

“Ninety-six percent of plans achieving 4 Stars or above in CAHPS also reached 4 Stars or above overall,” he said (Table 1). “These higher performing plans also had significantly lower member attrition rates than other plans. Sixty-five percent of plans with 4 Stars or more in CAHPS kept their attrition rate below 10 percent (Table 2).”

Table 2: Correlation Between CAHPS® Performance and Plan Attrition

“There’s no question that these are items that are very worth spending a lot of time on to ensure the best possible ongoing performance.”

With Medicare Advantage expected to reach 35 million members by 2025, CMS is using CAHPS as a way to ensure that plans are staying true to their value-driven mission as they expand their member populations, added Jason Z. Rose, CEO of AdhereHealth.

Thanks to Guidehouse research, we know the addition of a single Star rating could lead to an 8 to 12 percent increase in year-over-year plan enrollment. For example, improving from a 3-Star to 4-Star rating could increase revenue between 13.4 percent and 17.6 percent through increased enrollment revenue and additional bonus payments.

Many MA plans will have a great deal of work to do before they can see positive results for 2023 and beyond. Plans will need to develop a better understanding of how members view their relationships with their plans to deliver experiences that translate into higher CAHPS scores, higher Star Ratings, and better opportunities for growth.

Why CAHPS success has remained elusive for MA plans

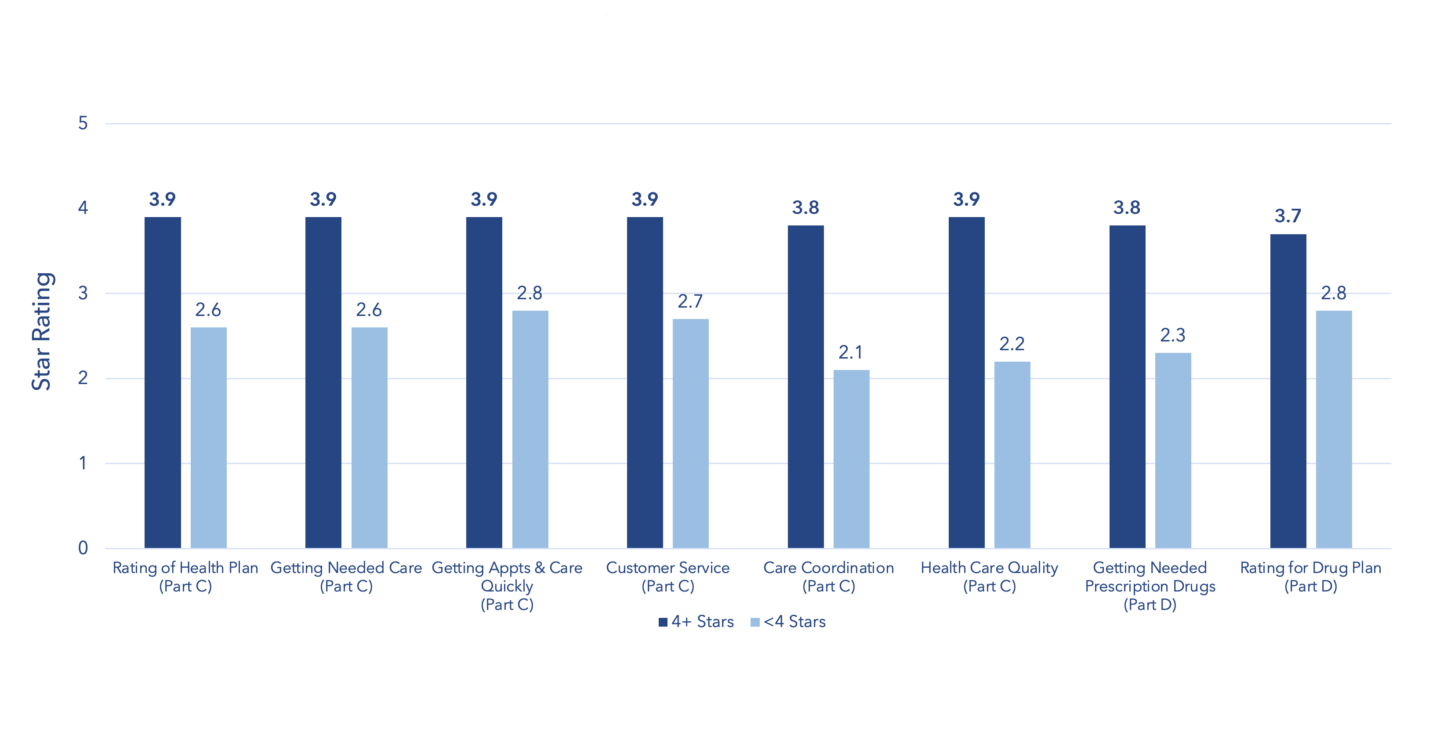

Even high-performing health plans have room for improvement when it comes to their CAHPS scores. CAHPS measure scores consistently fall below plans’ overall ratings, especially in complex areas such as care coordination and medication management (Figure 1).

That’s because health plans are not getting granular enough with their membership, said panelist James Lewis, Strategic Advisor to Health Plans for Risk Adjustment and Stars.

“We aren’t looking deep enough into the data,” he stressed. “We need to get down to the zip code and really start to identify and implement opportunities at a much more granular, tailored level.”

Figure 1: Average 2022 (2020 PY) CAHPS® Measure Ratings for ≥4 Star vs <4 Star Plans

Source: CMS. Part C and D Outcomes Data. Released October 8, 2021.

“The emphasis on CAHPS is designed to reinforce that,” he continued. “CMS wants you to build your network, your vendor portfolio, and your strategy so that you’re delivering exceptional, personalized experiences to everybody, especially those that are in the most need.”

Rick Whitted, CEO of US Hunger, agreed that the growing importance of CAHPS encourages health plans to take a very different look at the way they work with individuals and communities.

“CAHPS is all about understanding experiences,” he said. “It’s about being forced to step back and take the time to look at the people in front of us and listen to their stories. We don’t really do that well enough as an industry.”

| AdhereHealth clinicians spend an average of 20 minutes on the phone with each member approximately 3-5 times a year to achieve guaranteed adherence. |

“As soon as you start listening to people, you realize that dignity is very, very high on the list of experiences they want and need. If someone has no voice, and they’re not being heard in the clinical or non-clinical care environments, they don’t have dignity. That’s why the stats around CAHPS and plan attrition don’t surprise me: people aren’t going to stay in a relationship if they don’t feel connected.”

Health plans will need to deliver respectful and impactful experiences for their members if they are to see higher scores on CAHPS, lower attrition rates, and an increased likelihood of reaching the upper echelons of the Star Ratings system.

Identifying and addressing the key factors for improving the member experience

Social determinants of health (SDOH) have been high on the priority list of MA plans looking to boost their Star Ratings, but it has been difficult to crack the code on identifying non-clinical challenges and providing meaningful, personalized solutions at scale.

US Hunger continues to refine its hunger relief services to be more holistic and inclusive of other socioeconomic challenges contributing to food insecurity, Whitted noted.

“I would say that 99.5 percent of our applicants are in food deserts,” he said. “But when you think about it, people don’t just struggle with one thing when they’re in a desert. The region is also likely to be a pharmacy desert. It’s probably a healthcare access desert. It’s a green space desert. All of these things are going to be tied into why they’re food insecure.”

“About two-thirds of these people have lost their jobs or had their hours reduced. Three-quarters have chronic illnesses. These are people who are struggling in every way imaginable – and yet 74.6 percent of them tell me they do have health insurance. Let’s make sure their insurance is aware of these variables and is doing something to address them.”

The CAHPS survey is a critical vehicle for gaining that insight, Rose said, but plans must collect member input in the right way at the right times.

“Most plans do mock member surveys during certain windows during the year. Those are just a quick snapshot of how their members are doing [on experience],” said Rose. “There’s some value in that, but there’s more value in looking at the data on a daily basis and making adjustments in a much faster, more agile way.”

“The plans that are getting fours and fives in patient experience are looking at their data year-round and supporting their members in specific, actionable ways. That is then reflected in their CAHPS results and therefore in their Star Ratings at the end of the performance year.”

In Lewis’ experience advising health plans, addressing non-clinical member experiences requires a multifaceted approach that combines in-house improvements with strategic partnerships.

“Success relies on having a data strategy and a comprehensive ecosystem that allows you to leverage your native competencies and take advantage of what your partners are designed to do better,” he said.

“You wouldn’t spend the time and effort to develop a sophisticated food security initiative like US Hunger when you can just work with US Hunger, right? And you wouldn’t necessarily bring in 30 pharmacists to start a medication management outreach program from scratch when you can engage a partner like AdhereHealth that has the experience and established infrastructure to help you.”

Combining internal data and analytics initiatives with the help and support of specialist partners can help health plans develop the rich, longitudinal insights they need to improve experiences and CAHPS performance – without reinventing the wheel.

Looking to a future of experience-driven measurement for MA plans

Star Ratings now have a heavy emphasis on experiences, designed to further align incentives around what is best for members and their communities. This is a positive step forward for members and a promising opportunity for the Medicare Advantage ecosystem, Rose said.

But health plans only have a limited amount of time to maximize their performance for the upcoming measurement period, he cautioned.

“The next 60 days are the most important time of the year for MA plans,” said Rose. “For plans that are a little later to the game, these next few months will still allow you to start making some impact in March, when the CAHPS survey starts.”

“Once you get started with patient experience improvements, you have to commit to making it a year-round effort. You need to focus on experiences every day of the year so that you are continually delivering your best and not waiting until a few weeks before the deadline to start changing your members’ minds.”

Health plans can begin or continue this process by diving deep into their member data, both on the individual level and at scale.

“That is going to help you identify the most effective changes that can start to move the needle for you,” Rose stated. “It has to be a holistic approach. It has to be year-round. And it has to put the member first so that their outcomes and experiences are the best they can possibly be.”

To hear additional insights and learn more about how to succeed with CAHPS in the upcoming performance year, watch our webinar, How to Improve in 2022: CAHPS and the Patient Experience.

For more actionable strategies to improve CAHPS scores, download our white paper.