Published on .

The redesign of Medicare Part D has begun. Over the next few years, the Medicare prescription drug environment is going to change dramatically as the Inflation Reduction Act (IRA) and the associated Medicare Prescription Payment Plan (MPPP) change the game on drug pricing and access for tens of millions of beneficiaries.

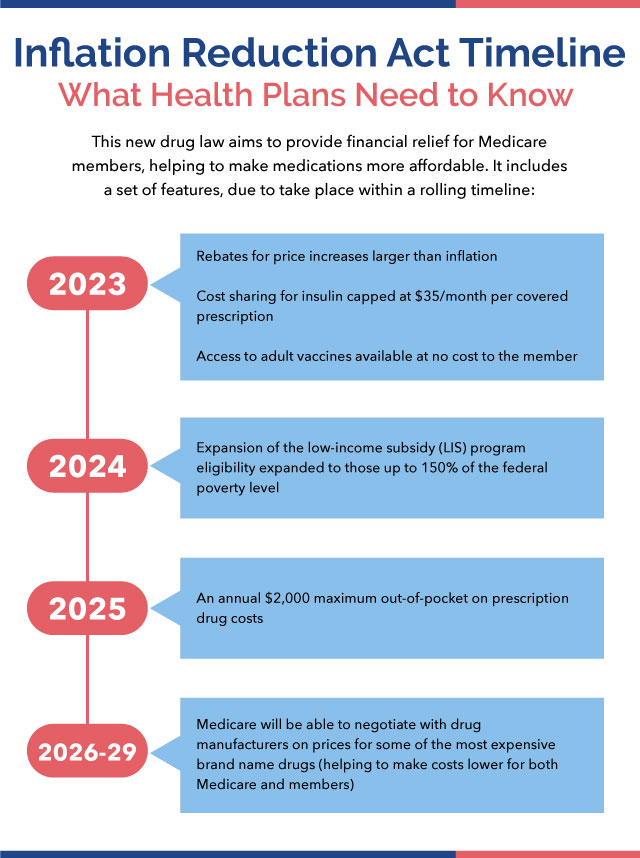

The 2022 law has already started to alter the way Medicare beneficiaries pay for their prescriptions. Starting in 2023, the IRA instituted a $35 cost-sharing cap for insulin products and rebates for price increases that exceed inflation, as well as expanded access to no-cost adult vaccines.

2024 has brought an expansion of the low-income subsidy (LIS) program to people up to 150% of the federal poverty line, while 2025 will bring an annual $2,000 maximum out-of-pocket on prescription drug costs. At the same time, 2025 will see in the MPPP requirement for Medicare Advantage prescription drug plans (MAPDs) to offer members the option to finance drug costs as capped monthly payments, rather than having to pay for medications all at once at the pharmacy.

Even bigger changes lie ahead in 2026, however, when Medicare gains the authority to negotiate directly with drug manufacturers on the prices of some of the most expensive brand name therapeutic products without biosimilar or generic competitors, which could dramatically change the upper end of the biopharma market.

While all these new rules are designed to lower costs for patients and make prescription drugs more accessible to those in need, someone will have to bear the costs offloaded from consumers—and that someone will include MAPD plans.

As the impacts of the IRA ramp up in 2024 and beyond, MAPD plan leaders will need to carefully strategize how they will shoulder the increased responsibility to cover a more substantial portion of medication costs, while still offering an attractive, positive experience to their members.

Achieving this balance will require MAPD plans to gain a comprehensive understanding of their member populations and their drug usage so they can identify opportunities for cost savings in prescription management and other clinical care services. By reducing avoidable spending and helping members navigate their care more efficiently, MAPD plans can ensure high-quality experiences while staying one step ahead of the changing regulatory landscape.

How might the IRA and MPPP impact MA plans and members?

The IRA has had both its advocates and its detractors across the payer, provider and patient communities, with the law sparking heated debate on how it will affect each group’s specific interests.

Early evidence from the White House indicates that more than 10 million people have received a free vaccine thanks to the program, while more than 763,000 Medicare members are likely to benefit from the inflation-based rebate program, since they are currently using medications subject to the adjustment.

For the Medicare Advantage world, however, the jury is still out on the long-term effects of the new rules.

On one hand, lower costs and improved access could lead to better adherence rates and increased member satisfaction, which could foster more positive health outcomes—with the potential for better CAHPS scores and Star Ratings for MA plans.

On the other, confusion over the changes and distrust of the health system, especially if plans attempt to control overall costs by cutting back on or establishing greater control through formulary changes and increases in prior authorization (for example), this could lead to unhappy customers, higher member attrition rates and lowered rankings on critical satisfaction surveys.

At a time when a third of MA members have at least 50 different plans to choose from, MAPD plan leaders will need to make a concerted effort to ensure they are keeping members informed of upcoming changes to their prescription drug benefits and making smart choices about how to offset costs internally without creating dissatisfaction among consumers.

Strategies for maximizing positive results in the new prescription drug ecosystem

MAPD plans that take a proactive approach to this evolving environment have a better chance of managing spending, maintaining high member satisfaction and remaining competitive in their target markets.

Doing so requires leaders to take a closer look at how their organizations balance services and spending across multiple areas, particularly for highly complex, high-risk individuals with greater reliance on multiple medications.

Generate a clear understanding of the high-cost member population

Identifying high-cost members will generate meaningful insights into the prescriptions driving plan spending. Some of these members may incur increased spending due to using one or two expensive, proprietary drugs subject to 2026 price negotiations, while others may be using a larger number of lower-cost drugs to treat multiple chronic diseases.

Either way, there may be opportunities to suggest alternative therapies, enroll members in chronic disease management programming, address socioeconomic barriers or close other gaps in care. And plans can certainly make strides to manage high-cost members by ensuring anyone who qualifies under expanded MTM parameters is up to date on their comprehensive medication reviews (CMRs) to boost adherence and prevent any adverse events.

When supported by a robust technology platform to analyze and present data in an intuitive manner, plans can both mitigate their financial burdens of caring for high-cost members and improve member satisfaction among those being contacted for extra support and attention.

Communicate well and often to bolster education about IRA-related changes

Effective communication about changes to cost and access tied to the IRA and MPPP is a powerful weapon for ensuring members are making informed choices about their medication usage, as well as taking full advantage of benefits available to them.

Plans will need to develop educational materials that are clear, concise and appropriate for engaging their member populations, especially around complicated concepts like rebates tied to inflation rates and the reasoning behind approvals or denials. These materials must be available through a variety of different channels and in multiple languages to ensure every member can absorb the information appropriately. Plans will also need to offer easy-to-access assistance with applying for benefits and understanding the final out-of-pocket costs for drugs subject to adjustments.

MA plans that have already established strong relationships with their members via regular outreach around medication adherence and chronic disease management may find it easier to integrate additional conversations around drug pricing into their existing outreach cadence.

Lean into programs that help reduce costs of care

Finding ways to offset the plan’s increased cost burdens over time will be essential for maintaining financial sustainability. Instead of simply trying to cut spending on the drugs that will now be costing more, plans can get creative about finding efficiencies in other areas of administrative operations and clinical care.

For example, investing in medication optimization programming will help to uncover drug therapy problems (DTP) that could lead to adverse drug events, which are implicated in nearly 100,000 hospitalizations among the elderly each year. Maximizing DTP identification can not only reduce the skyrocketing costs of these avoidable hospitalizations, but it can also improve adherence for members and support better overall health outcomes, thereby avoiding future spending associated with worsened health conditions.

Plans should consider investing in analytics solutions that provide a broad and holistic picture of member spending and clinical needs to help them highlight hidden opportunities to close care gaps and reduce avoidable costs without the perception that they are making it purposely difficult for members to take advantage of the IRA’s consumer-friendly provisions.

Thinking ahead to the future of prescription drug spending

It will take several years before the health system understands the full scope of the IRA’s effect on drug prices and affordability for consumers. But as the new regulations roll out, health plans have the opportunity to implement strategic changes to the way they manage drug spending to stay ahead of the curve.

Prioritizing appropriate utilization of prescription drug resources while maintaining high member satisfaction can be challenging for plans, especially those that do not have the right analytics infrastructure in place to gain valuable insights into their spending.

As the IRA unfolds throughout the rest of the decade, plans should consider investing in transparent, high-touch, member-centered strategies to proactively manage health conditions, maintain member satisfaction and contain costs holistically to support better long-term results for all.

To learn more about how plans can achieve their goals and stay ahead of CMS requirements with an SDOH-first approach to medication adherence, contact AdhereHealth for a consultation.